- The mortgage procedure goes through a call.

- There are no real contact towards lenders.

- Loan providers don’t possess consent to run from the county.

- The bank requests for money to get taken to them.

Guarantors versus. Co-Signers

The co-signers and the guarantors assist get the mortgage approved hence is the place this new similarity stops. Put differently, co-signers was co-people who own a secured asset, when you find yourself guarantors haven’t any claim to new investment bought by borrower.

Should your borrower will not meet the earnings standards place of the loan providers, the co-signing arrangement happens. In cases like this, brand new advantage was had equally by the each party: the newest borrower and you will co-signer. not, an excellent guarantor may be requested so you’re able to step in when borrowers has adequate income but do not be eligible for the loan on account of worst borrowing from the bank records.

And additionally, co-signers undertake alot more economic obligations than just guarantors would since co-signers are equally in charge right away of the agreement, whereas guarantors are only in charge should your borrowers default and you can fail to get to know the personal debt.

The new guarantor loan has actually a critical affect the household affiliate or pal just who co-signs unless you result in the money. When they support the loan up against assets, they run the risk out of losing they.

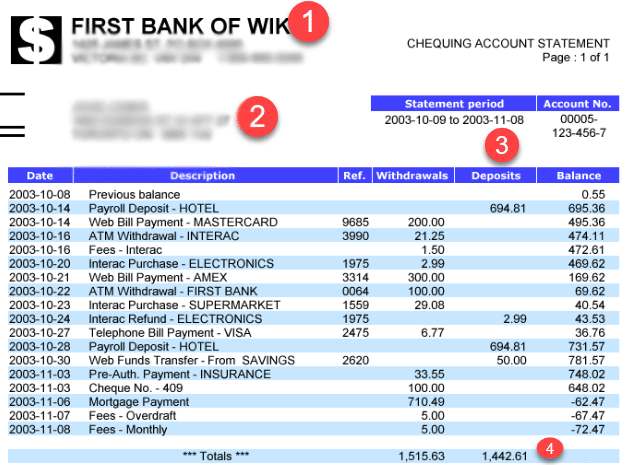

- In the event your debtor try not to pay the mortgage, the financial institution is located at out over the guarantor, who is required to capture up with new costs.

- Loan providers have the Persisted Percentage Power (CPA) that he/she can make the payments straight from the bank membership.

- When your membership has lack of fund, plain old debt collection procedure begins where personal debt is introduced on to the obligations recall service.

- Regarding the worst situation, the lender might take judge action facing both guarantors and you may borrowers. An identical might be filed on the credit reports too.

Is a Guarantor Sue a borrower?

Sure, this new guarantor towards the mortgage can be sue if the he/she defaults while the guarantor had to pay off the whole debt matter.

Achievement

Bringing a loan is actually a fairly difficult process, specifically for people who have worst if any borrowing. Good guarantor loan at the same time was a cool method away from enabling someone else obtain the money that they you prefer with somebody co-signal in their eyes. For the disadvantage, yet not, the speed is generally very high and thus is the Annual percentage rate.

Whichever brand of loan your make an application for, ensure that you have a look at terms of the newest agreement cautiously prior to registering. Spend your time knowing the dangers and consider the advantages and you may downsides just before continuing. In the long run, be sure to compare guarantor funds and cherry-select the one which serves your position an informed.

Individuals during the Altitude Mortgage brokers promote of numerous decades of experience within the starting money the right way. If you are looking for to buy a house, contact one of the Financing Officials now and we will make it easier to through the Home loan app process.

Which guarantee decreases the chance for a loan provider and gives you in order to obtain on economical costs and get away from possibly big repayments down the line.

Particular criticism we see

- Performed the lending company have the guarantor’s securely told agree to are an excellent guarantor?

We are including browsing give a lender to be certain their user’s credit history has no one bad guidance submitted regarding the loan in the event that we’ve got found that proportionate monitors will have found you to definitely the debtor decided not to sustainably pay it off. If we elizabeth a spot where the financial should have realised one any more lending is obviously unsustainable, our company is probably give the lender to acquire so it next credit removed from its user’s credit reports completely.

Whether your debtor does not pay off the borrowed funds, the guarantor is legally bound to settle the loan. For this reason, this new guarantor need to signal a guarantee and Indemnity are required because of the the consumer Borrowing from the bank Act 1974. It should be finalized, and thus the latest guarantor features sort through the new document and you can resource knows he or she is legally obliged to just accept obligations towards the installment off the borrowed funds if your debtor non-payments.

Payday loans: that is a form of mortgage that provides your having money until your following pay day. These plus are far more expensive and you may need to pay her or him back into strong the second pay check. Payday loan would be hazardous if you aren’t able to pay them-they both set anyone higher for the loans.

The lender will want to make sure the retiree is actually able to repay the loan when your debtor is not able to pay.

This short article takes you owing to everything you need to discover Guarantor Financing, the way it operates, qualifications, liabilities, rates, etcetera.

- While secured personal loans may give you a lowered interest rate, you can also clean out your own asset abreast of standard.