The fresh FHSS Design allows you to use your awesome money to help you save money to suit your earliest domestic. This helps earliest homeowners rescue quicker of the concessional tax treatment’ out-of extremely.

Making use of the design function it is possible to make voluntary concessional (before-tax) and you may voluntary non-concessional (after-tax) benefits on extremely for the intended purpose of preserving to possess a good house. Then you’re able to connect with launch these types of finance, and additionally any associated income, to get toward purchasing your earliest household.

Is permitted use this design, you should be an initial property owner, in addition to following the a few comments must apply at your:

You’ll inhabit the house or property you are to buy, otherwise plan on surviving in the home you are to get right as possible

You want on surviving in the house or property for at least six days inside the first year you own it (once you’ve moved inside the)

To make use of so it plan, try to submit an application for and you can located a great FHSS determination before you sign this new price for your brand new home. For additional info on so it design and just how it works, visit the Australian Taxation Work environment (ATO) webpages.

The latest property rate caps have been recently revealed to your Earliest Home Loan Put Design additionally the House Guarantee. At the same time, the home price caps beneath the New home Be Sacramento installment loan no credit checks no bank account sure continue to be as the what they was indeed if design was launched.

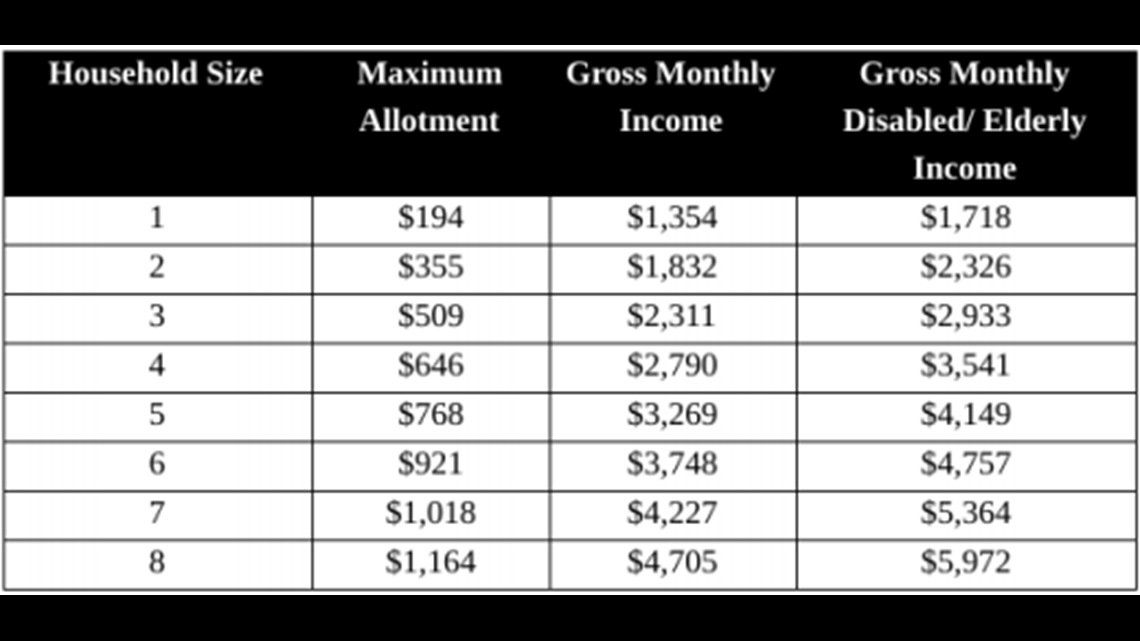

According to Assistant Treasurer Michael Sukkar, they are the newest assets speed hats towards the Very first Home Loan Put Scheme as well as the House Make sure by .

Just like the just one mother that have one money to work well with, chances are high to get property if you’re controlling the unmarried-mother every day life is will be persistence. But not, it’s entirely possible to find a property on one earnings. Listed here are some tips to have solitary moms and dads which need to buy their particular domestic.

Take advantage of the schemes

There is told you which plans appear, but you would should do their look and implement so you’re able to experience the advantages. You can wish to do some digging to discover and that strategies we said you’re qualified to receive. Most of the schemes we discussed manufactured to help individuals buy property without as many barriers; protecting adequate currency to own a great 20% deposit is pretty tough at the best of times. Therefore, whenever you can have fun with one or a few of the systems otherwise pledges more than, it can be useful. Performing this could end upwards saving you several thousand dollars.

Save, save your self, cut

Immediately following you are tied towards a home loan, you’re in a long term partnership to 30 years. Your children are most likely will be grown and you will out of the house ahead of the home loan name has ended. Before signing the dotted range, it may be best that you save up normally currency just like the you could getting safe keeping. Inside doing this, you can use it for the best by having a counterbalance membership, while making even more repayments, or maybe just with money seated out to have a wet go out.

Have a very good credit rating

With good credit history is essential when you find yourself lookin buying property towards a low income. Making certain you’ve got a good credit score is vital to make sure you’re being energized a low interest and also have compatible mortgage conditions. As opposed to good credit behind your, not only will be your variety of loan providers restricted to simply an excellent few, you’re likely will be energized far more desire than simply you’d like. Much more interest = higher money = a fortune over time.